Source: Guns America, article by Paul Helinski

These occasional “Prepping Theory” columns can be hard to write, but I feel that unless we periodically talk about why we do this and what the priorities are, it is hard to maintain any kind of enthusiasm. We are after all preparing for the end of life as we know it, and it’s hard to not feel like you are nuts sometimes, or all the time. This topic, investing, is perhaps the hardest thing to talk about, because I know that so many of the tens of thousands of the readers of this column (25,000 last month) are not preparing sufficiently for what I now know is a coming collapse. Many people are sitting on retirement savings and investments, hoping to weather whatever the storm is coming, and though they could put some of those assets into actual preparation, they think that a gun and a savings account will guarantee them survival. It won’t, but that isn’t the point of this article.

For now I’d like to talk about where to put investments, because the truther/prepper community is so inundated with gold bugs, mostly who sell gold. I don’t think that gold and silver are going to be your best investments, because we don’t know when the crash will actually occur, and those metals are heavily manipulated in their prices. My point of this article (so you don’t have to read all the way down if you don’t want), is that if you are going to invest, invest in what you know. The purpose of investments is to store money and hope it appreciates for the future. Invest in things of tangible value that you know well and that you can find good deals on. Gold and silver are great long term investments, but don’t think that you are smarter than the people who are setting us all up in this huge mess. You’re not, and I’m not. If gold and silver were windfalls waiting to happen, soon, do you think they would really let us buy any?

One thing you will have to accept, regardless, is that your paper investments aren’t going to weather the storm, period. I don’t care how safe you think your paper assets are, they aren’t even really paper. All of your wealth, be it stocks, bonds, savings accounts and other paper asset classes, are nothing more than the numbers on the screen proving that you own them, and the people who control those computers can take them away. Maybe I’m totally wrong, which I hope more than anything. But I’ve been digging now for years, and I believe we are getting very close to the final bell. That bell is going to ring, and when it does, be it by war, (engineered) disaster, or some kind of black swan event that none of us could possibly foresee, those screens are going dark. I wish there was a caveat that I could add about owning paper assets, but I can’t. Warren Buffet recently bought railroad stock. I guess he figures that no matter what, people will have to ship stuff around for any kind of commerce.

For him that might work because he bought the stock and he’ll get his paper stock certificates. For us that isn’t going to happen. If you remember back to Hurricane Sandy, when Manhattan was flooded, one of the things that the water got into was the DTCC, where all of the paper certificates for the ownership of all paper assets are stored. Then there was a fire. Now, if you had care of the paper records for the ownership of most of the nation’s assets, wouldn’t you silicone the door to the vault? Wouldn’t you have a pretty good sprinkler system too? Nuf said there. Research it yourself.

For him that might work because he bought the stock and he’ll get his paper stock certificates. For us that isn’t going to happen. If you remember back to Hurricane Sandy, when Manhattan was flooded, one of the things that the water got into was the DTCC, where all of the paper certificates for the ownership of all paper assets are stored. Then there was a fire. Now, if you had care of the paper records for the ownership of most of the nation’s assets, wouldn’t you silicone the door to the vault? Wouldn’t you have a pretty good sprinkler system too? Nuf said there. Research it yourself.

Then there is gold and silver. These two metals are in some ways the same and in some ways very different. Gold is the darling of the preppers, mostly because it stores a good deal of money in a very small space, and because gold has always been the currency of last resort throughout the ages. Think about it. If you found a 500 year old chest buried in your backyard, would you be hoping that it was full of 500 year old paper currency? No, you’d hope it was full of gold, because even if paper currency had survived 500 years, it would be worth no more than collector value. The “full faith and credit” of the country that printed that currency died when their reign died. Whereas 500 year old gold is still gold. It would most likely buy an equivalent ***value*** today of what it could buy back then. Gold has always backed the credit of paper money, and it backed the credit of our paper until Richard Nixon detached it from the dollar in 1971. Historically, that always happens. A currency starts off with gold backing, then as the government needs more money than it has gold, they dilute the gold then eventually abandon the security altogether, usually for fighting wars. Sound familiar?

Silver, on the other hand, has always been a “monetary metal,” meaning that it is used for currency itself, and it was also a monetary metal in the United States until 1964. These days most of the physical demand for silver is in electronics, solar panels, and other industrial uses, so when you think about the price of silver, you have to figure all of that into your calculations, both up and down. Unless suddenly silver is brought back into monetary use, the demand for silver is largely a factor of the world economy, which is currently headed into the bottom of the toilet.

This is a chart from this past Thursday when I am publishing the article. Since the price has been above $1,200, the same 10am squash down has been hitting the price of gold. Who knows where it will end up before the collapse and after the collapse. As George Carlin said, “it’s a big club, and you ain’t in it!”

The reason I would suggest caution with investment in both metals is that the prices are heavily manipulated. The gold bugs are all up in arms over the last couple weeks because gold broke is moving average and is now back up over $1,200 per ounce, but big deal. I have watched the daily ticker on gold and silver for about two years now and I can for sure say that those prices don’t reflect anything real. If they did, silver would go up and down as industrial contracts created demand. But silver usually tracks gold pretty close. And as for gold, watch it yourself for a couple weeks. Whenever there is a spike, due to world events or bad economic news, at 10am the trading computers kick in and push the price back down with what they call “naked shorts.” With Greece imploding, the Euro in trouble, wars all over the world escalating, and Russia and the US rattling nuclear sabers, gold should be skyrocketing, but at 10am EDT almost every day, the price gets hammered down.

Next day, the same thing happens. Maybe the computers broke in allowing gold to spike up over $1,200.

So if gold is being artificially suppressed, it must be a great buy right? Well currently you can buy gold and silver at those paper prices with very little extra added by the dealers over the spot price. I’ve seen auctions on Ebay end at below spot. But I don’t think there is any guarantee that gold and silver are going to be the safe haven that many people think. A lot of people are dumping the gold and silver because they listened to the gold bugs a couple years ago, and the prices haven’t risen. Those gold bugs make a lot of noise about the price of the metals being below mining costs, but if you can buy the actual metal at that price and have it delivered to your door, that is the value of the price of that metal, today, manipulated or not. Thinking that it is a windfall waiting to happen is no different than any other gamble.

If they have been suppressing the price of gold and silver this long, who is to say that those prices won’t be manipulated after the crash? Who is to say that the gold and silver won’t be confiscated? FDR confiscated gold in 1933 for what was a much smaller financial crisis than what is coming now. Do you remember the first couple of years after 911? Do you remember how we agreed to everything that the government suggested, wars, Patriot Act, Homeland Security, TSA? There are still tens of millions of Americans who believe that 911 was done by Arab terrorists, even though the official story is impossible when you consider the laws of physics. You may even be one of the people who fell for the misinformation about 911 and other government hoaxes, and who think that Fox News is the Conservative Patriot channel. Would you believe Sean Hannity if he told you that you are not a patriot if you don’t sell the government your gold and silver? How many people do you know who would? Most of them.

What happens when the bankers lose the ability to control price? My guess is that when this happens, the dollar will be losing value quicker than you can keep up with how many dollars you would trade for your ounce of gold, and trading any dollars would be foolhardy. That means you would have to transact with the gold itself. Will you swap a gold coin for a 50 pound sack of beans when that happens? Even a 1/10th of an ounce bar for a sack of beans would be three times the current price, but that may be your best bet, I don’t know. What if the cabal has a rabbit under a hat and they are able to stretch this out for another generation? What if you put your retirement savings into gold, only to have the price suppressed into the $300 range where only the jewelry trade is interested in buying it? You’re screwed.

What is the “value” of a sack of beans when you are starving? Will someone be willing to even swap you this for that? Silver is even more of a gamble. Even the US mint silver coins look like play money. I don’t see a huge benefit in stacking gold gambling on a windfall, when most likely nobody would swap you food for gold anyway.

There is also an enormous amount of subversion and misinformation when it comes to gold, worldwide. The gold bugs (who mostly sell gold) these days are preaching that we are at “peak gold.” That means that we are now buying more gold than the world is producing, and the world can’t produce more. This is a complete fallacy, because those same people know absolutely that right here in the US the government has kept huge gold deposits hidden from the public, and there are clear records of enormous caches of gold throughout history that today are unaccounted for. If you go to the Grand Canyon there is a no access zone that is a gold mine, just sitting there that nobody has every dug up. Hundreds of tons of gold were stockpiled by world powers for millennia at this point, and none of that gold factors into the “peak gold” fallacy being preached today. The gold bugs can argue that China, Russia and many other countries have been collecting gold for many years, and they have, but everyone knows that, and our friendly local banker cabal I’m sure has factored that into play. Remember that it was China that took all the 911 rubble and “recycled” it, making sure that it would never be examined by the truthers who everyone knew would eventually figure out that 911 was impossible. China is totally in on whatever the cabal is planning. And Russia has been in the pocket of the Rothchilds since WWI time. All of the bankers are setting themselves up to win, and us to lose. There is nothing we can do.

So what do you do? That’s the problem right? I’m sure many of my readers have retirement savings in the 6 and even 7 figure range, so even if you took all of my advice in this column to heart and put in the time and money, there would still be plenty of money left in the bank. You can’t store more than maybe $10,000 worth of freeze dried and bucket food in a reasonable space, and even if you went all the way and bought solar, wind, a well system, and a bugout location, you still have to store the rest of your savings in the something that will retain value after all this is over. It could be that the next phase of humanity is a Mad Max economy of complete scarcity, but for those of us alive today, this probably wouldn’t be true. As even the mainstream TV show from Jesse Ventura proved, the cabal aren’t building FEMA camps and bunkers in the Ozarks for nothing. They expect a rough patch, but there is a plan for a world after the collapse, and what that would look like I have no idea.

What I do have an idea about is that ***things*** will still be in demand, and that is the point that I am meandering to here. I think that if there is commerce after a collapse, gold and silver will still be manipulated. But regular old things people want will not. A sewing machine will still be worth a sewing machine worth of food. A musical instrument will still be worth a musical instrument in laundry soap and toilet paper. If there is such a thing as trading value, those things are going to hold their value better than anything, and in the event of no collapse, many of those things will increase in value regardless, just because of inflation.

But to take one step back first, let’s go over the scenarios of what could happen. There is a huge divide in the prepper world between people who think that the global financial collapse will cause inflation, meaning that the paper currencies will be worth less in buying physical goods than the are now (or they end up being worthless). Then there are those who say that when the derivatives and banks eventually collapse, money will disappear worldwide, so money, “cash” in either physical or electronic form, will be scarcer. Therefore money will be worth more, which is called “deflation.” I can’t say I have an opinion that isn’t just regurgitation of either side, which you can find elsewhere, but I will make a couple interesting points about ***things***.

If the paper currencies of the world “hyperinflate” and become worth little or nothing (which historically has been the fate of every unbacked paper currency), things will be valued in whatever monetary system takes its place. I think that the nations of the world are in a private war to control which currency will do that, and if you don’t believe me just go watch a few Youtube videos on the Federal Reserve or other financial collapse topic. You’ll see an add from Jim (Shill) Rickards, whose book I lambasted here months ago. He is some kind of paid salesman for what is called the SDR (Special Drawing Rights) that is yet another unbacked currency created by the International Monetary Fund. Jim isn’t alone though. China has indeed been stockpiling gold, and there have been reports out of Shanghai that billboards are popping up advertising a new gold backed currency. Again, who knows, but it doesn’t matter. In hyperinflation, the ***things*** will be valued in the new currency, and it will carry the same comparative value. A loaf of bread may be worth a box of ammo if food is scarce and violence is rare. But what will it be in gold? Or silver? I’d rather have a box of ammo.

Now let’s look at deflation. If dollars are worth more (highly unlikely for more than the first few weeks), wouldn’t it be stupid to buy ***things*** now because they will be worth less as cash gets so scarce? Yea, for a time the things are going to be worth nothing as the world struggles to survive, but to you, so will gold and silver. If you prepared sufficiently for those difficult days and you did indeed survive it, other people will have survived it too, and as trade re-establishes itself, they are going to want ***things*** again. The companies that make those things will long be out of business, and the ***things*** will also get scarcer, which will make them more valuable against the things you want.

The banker elite already get it. A Picasso recently sold for 179 million dollars, because it was a safer place to store that much money than stocks, bonds, or unbacked paper currency in the mattress. The ultra rich all know what is coming, and they are storing their wealth in things that they can carry, and that they know will have equivalent ***value*** after the system burns down. Greece may be the lynchpin that lets the whole system go, and that problem has now been pushed off another month, but the Greeks are taking all of their money out of the banks and putting it into ***things***. It is an electronic bank run as people quietly buy expensive cars with what were thought to be “safe” paper asset savings accounts not too long ago. Greece is next to Cypress, and in Cypress, back in 2013, the banks took up to 48% of depositor bank accounts due to a debt crisis.

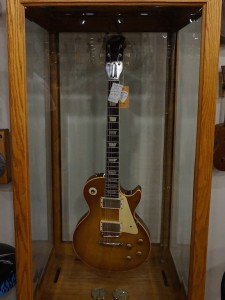

I know it took a while to meander over to my actual point, but I’m not done. The reason I called this column Guns & Guitars is because those are two things that I know a lot about, and both are things that do not depreciate over time if they are taken care of properly. If, as I desperately hope and pray, we just keep going for decades and centuries to come without any collapse, I can pretty much guarantee that guns and guitars that I buy today will at the very least track inflation. Our financial system requires growth and inflation to operate. That is how a Ponzi scheme works, and if we can keep printing fake money for another few centuries and get away with it, great, I’m in. But if you know that fact about the entire western banking system, it should be a lesson in what you can buy that will store your money, and maybe make you money, not in pure numbers of currency values, but in actual ***value*** swap.

What do you know about (besides guns)? Cars? Model trains? Art? Because knowing about it is the key. The economy is in the toilet right now and cash is king. Buy stuff right, and it is the best financial insurance you can acquire, far more safe than gold and silver, because the bankers couldn’t care less about manipulating the price of a Gibson Guitar or a Juki sewing machine, or for that matter a Ruger Blackhawk. If you are going to gamble and “take your money out of the bank,” gamble on something you know.

I, for instance, would never gamble on art, because I know nothing about art. Cars to me depreciate too much, even if you don’t use them, and they don’t become collectable until they are really old, plus they take up a ton of space. Collectibles require someone who cares to collect them, and that goes for a lot of antiques too. If I knew a lot about antiques, they might be a gamble, because I would know what is more likely to have demand down the road. I would hope that antiques would be much like art and eventually become a good investment, but I don’t know anything about antiques. Likewise collectible coins. There is a huge sales force out there that is trying to sell old coins at premium prices, claiming that rare coins will not be subject to confiscation that way that bullion coins will be, but I question all of that. Someone has to care, and coins may have a great track record, but I don’t see the world elite gravitating to them the way they do to art and high end real estate.

Guns I think we all agree will always be worth utility value as long as you can get ammo or you also store the ammo. Ammo itself is a good investment, and don’t believe the stories that ammo has an expiration date. If you keep it dry and out of serious humidity, ammo lasts forever. What do you think is going to be worth more in a post collapse scenario, 5 Mosin Nagants and 2,000 rounds of ammo or an ounce of gold? That is about equivalent value in today’s prices. Er… sorry if you just spit your morning coffee all over your computer.

Musical instruments I also think will retain much if not all of their utility value, and possibly some of their “art” type value. There are Gibson Les Pauls and Fender Stratocasters from the 50s and 60s that are worth $20,000 and (much much) more these days. What tells me that collectible guitar values will survive the collapse is that there have been record prices paid for extremely collectible guitars over the last decade. George Harrison’s Telecaster from the Let it Be album went for almost half a million in 2003 at auction (his wife bought it aw). Guitar Center also purchased Eric Clapton’s “Blackie” Fender Stratocaster, as well as his vintage Gibson “ES-335,” and Stevie Ray Vaughan’s “Lenny” Stratocaster for over $2.4 million from the Clapton Crossroads Centre charity auction at Christie’s New York in 2004. Old collectible guitars are just like guns in that at some price-point, I’d say north of $10,000, they require a provenance, or paper trail, in order to worth more than utility or general collector value.

I would also argue that, being a guitar nut myself, you can extrapolate that rule into some current and recent production guitars that come with a built in provenance. These would be the custom shop guitars and artist signature models. The Special Reserve page on Musicians Friend (a Guitar Center entity) will show you some of the guitars I’m talking about, generally in the $1,000 – $10,000 range. If we don’t collapse, I’m pretty sure that they will keep suppressing the prices of gold and silver, but even an obscure Warren Dimartini (Ratt) import Charvel will be worth a comparative value 20 years from now that it is today. Gibsons and Fenders will be even more of a sure bet, and all of those guitars, will garner a decent amount of the new currency and comparable value once society gets back to a semblance of normal life. Tens of millions of Americans either play guitar or wish they did. Post collapse there will be plenty of time to practice instruments with no screens to look at. I do think that there will be electricity, which is why Warren Buffet is investing in railroads. Electric plants make power locally, using fuel from far away. That will be the center of commerce.

Violins also seem to remain collectible, but those values seem to be more about craftsmanship and sound than a name brand. The same goes for brass, woodwind, and brasswind instruments. In general if those instruments are higher quality, they carry a higher utility value. Once the collapse puts instrument companies out of business, instruments will be at a premium. Pianos are not easily moveable, and drums take up too much space and don’t travel well, but hey, buy what you know. You have to invest in what you know, and get great deals with the cash you have in hand and don’t need to live off of.

One final warning I will make is about real estate. There are only two things that have limits in the world. Time and land, but land doesn’t get scarcer like does time. If there are fewer people, there will be less demand for housing, and certainly business real estate will be useless. The supply of homes at present is enough for everyone in the US. Farm land is at a premium right now, but I question if all real estate is in a comparative value bubble right now. I guess we’ll see. The elite are bidding up prime real estate the same way they are bidding up Picassos, but as I’ll note below, I think real estate is a crap shoot.

This is a long one, but I only wrote this article because there are soooooo many gold bugs in the prepper world preaching gold, and I feel that it is for the most part misguided for shlubs like us. I don’t think that any of the gold bugs know anything more than I do about how the inherent value that is in gold and silver will price out in dollars or value in the future. And don’t believe for a second that the sheep would question a new gold an silver roundup for “national security” so we can fight another banker war for the control of poppy fields. Gold and silver might be the only true investments that will survive this coming absolute melee of humanity, but if that happens, people like us won’t be concerned with wealth. If it doesn’t all burn down, any investment is a risk, but paper, and leaving your money in a bank is riskiest of all at this point. I say invest in what you know. I have gotten some killer deals on guitars of late, and guns are also struggling along with the rest of retail. There are great deals on guns right here on GunsAmerica, and ammo is comparatively cheap right now in the best investment calibers.

An exhaustive analysis of the topic this is not, though I have kind of gone on and on (and haven’t stopped yet lol). The gold bugs are salesmen. All the stuff they say sure sounds good, but when you boil it all down, I think there is more uncertainty in the future prices of gold and silver than in anything else, and they are extremely dangerous investments in the span of our lifetimes. In 500 years the guitars and guns and sewing machines will be irrelevant, and gold will still be gold. Ultimately, I do believe that our successes and failures in life are governed by our Creator, but He/She/It seems to have a very difficult sense of humor when it comes to human suffering. All we can do is what we can do, and ultimately the only path forward is forward, to an end we can’t control. In the here and now, where we are trying to guess what happens, this very long point is that we should not be listening to one idea and grabbing it as the only possible outcome. Anything could happen. Your best guess is just as good as any other. This whole thing is dangerous. It’s a big club, and we ain’t in it.

Source: Guns America, article by Paul Helinski

3 Responses

Great article Dane. I know it's been on here for awhile but I haven't had the chance to read it until now. If you ever want to come to Santa Fe NM and stay at my Hacienda I would love to have you here. You could also perform with other great musicians at the Famous El Farol on Tuesday Night for the Open Mic Blues Jam. World class musicians, Grammy and Multi Platinum winners, who are AWAKE. as well as the audience that is very open to the subject of Geoengineering!

Finally an article on the subject of preparation that makes some sense to me. I have a lot of people around us into gold and other fiat type currencies as a means of preparing for the worst. That always seemed a little futile to me since I can't eat gold and any sort of government approved currency would be regulated, watched or confiscated in a disaster (unless all hell breaks loose beyond the "power's that be's" ability to control – then guns, ammo and food are going to still reign supreme). Practical tools and "things" will be worth more – in addition to what TR mentioned above: the SKILLS to use them – in any sort of disaster. Gardening, food preservation,sewing, building, welding, mechanical work, electrical engineering, animal husbandry, hunting, fishing, the ability to get firewood and water……..

My grandparents and great grandparents (and those before them) survived (and lived long lives) with much, much less than we have today primarily because they were willing to work and had actual practical SKILLS to back up their work ethic. Now is the time to cultivate those skills!

Great article. Knowing how to actually play a guitar and run/fix a sewing machine and fire a weapon are the kind of skills i have spent years on, because in a crisis, it's not just what you HAVE, it's what you KNOW that's going to get you through rough times and make you a valuable community member in the post-crash world. Develop skills before you rush out and buy more stuff. Skills weigh nothing, require no storage space, can't be stolen, only shared. Skills separate survivors from casualties. Remember kids, don't be scared, be prepared! Never stop learning. Every camp of ragtag survivors will want music after dinner, even if dinner is fried termites. As Charles Ingalls said before he set off for a long absence to find work "Take care of the old fiddle Caroline. It puts heart into a man."